Is solar a good investment in Spain?

It’s a question many people ask. While stock markets are volatile and inflation never ceases, solar panels are a risk-free solution to reducing expenses.

But do the maths really add up?

According to solar panel installer Marblanc Solar, one client is on track for a 17.7% return on investment (ROI) in the first year of their solar installation.

In this article, they’ve told the Olive Press how it all works.

You’ll learn:

- How to evaluate solar using 4 key metrics

- Red flags to look for when receiving solar quotes

- The part of a solar installation that matters most for long-term savings

If you want to see your own ROI calculations, Marblanc Solar offers a Free Solar Survey. You can request yours here.

Otherwise, let’s dive in!

The Key Difference Between Solar and Traditional Investments

If you’re considering a solar installation, you’re probably concerned about getting value for money.

Some people choose solar to reduce their carbon footprint.

But Roman Mitchell, co-owner of Marblanc Solar, says that “9 out of 10 clients are interested in solar to lower their bills.”

“It surprises me how many clients are actually investors,” Roman added. “They view solar more as an investment than an eco-friendly upgrade for their home.”

But here’s where the key difference lies.

While many people like the idea of slashing bills, there’s often hesitation.

Would they get a better return by investing instead?

After all, you can’t earn money with a home solar energy system. At least, not directly.

So what’s the case for solar over investing your money into something else?

How One Costa del Sol Homeowner Is on Track for a 17.7% Annual Return

Marblanc Solar says it has proof of solar’s investment potential, after one client’s bills showed they’re on track for a 17.7% annual return.

How are they so sure?

Adam Millington, co?owner of Marblanc Solar and a qualified electrician, showed the Olive Press the client’s bill from three months after their solar installation.

It revealed a remarkable result.

The client actually had a negative electricity cost. They’d earned €9.44 into their “virtual battery” for selling more electricity back to the grid than they consumed.

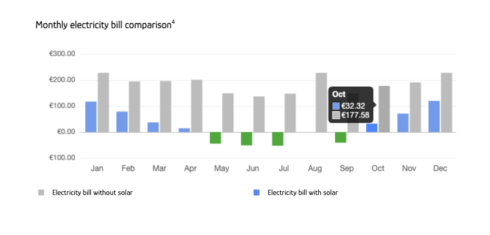

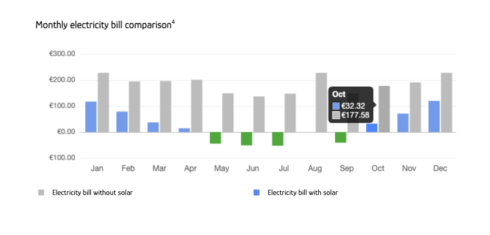

Adam said: “Our initial proposal predicted the client would be paying an average of €23.50 for electricity each month.”

“But the results were even better than we predicted, with the client paying nothing for electricity this last October.”

How Marblanc Solar Calculate the ROI Figure

Adam said the client’s annual savings for the first year are predicted at €1,946.

(Marblanc Solar bases all their estimations on the cost of electricity – without including standing charges or taxes.)

Here’s how they arrived at that conclusion:

- They looked at the electricity costs prior to going solar, which were €185.64 a month on average.

- They calculated the annual cost of €2,228.

- They ran a performance model to predict that 18x 595W solar panels would cut annual costs to €282.

- When subtracted from their previous annual costs of electricity it leads to a saving of €1,946 per year.

- Dividing that by the cost of the system leads to a predicted annual ROI of 17.7%.

Adam said: “Our prediction accounts for slightly higher bills in winter as the power output is reduced.”

“But our modelling predicted the client’s October bill would be around €30.32 – and instead the client earned €9.44 in credit.

“This means the final ROI figure for this first year could be much higher than 17.7%.”

Adam added that Marblanc Solar include investment calculations like ROI during their Free Solar Survey for a new client.

It helps to demonstrate the value of solar.

For example, you can compare a predicted ROI of 17.7% to something like stock market index returns – which have averaged around 13.6% annually over the past decade.

“But here’s the interesting part,” Adam added.

“The hidden bonus of investing in solar is that inflation increases your actual savings, instead of eating into your earnings.”

4 Financial Metrics to Evaluate Solar as an Investment

Marblanc Solar has a unique quoting process.

Instead of sending an itemised bill, they carry out a Free Solar Survey.

First, a qualified survey engineer visits the client’s property with a drone to measure the roof space, orientation, shading and angle.

Then, they plug the data into Pylon – the world’s leading solar design software – to run performance calculations. This allows them to come up with accurate estimations.

But Marblanc Solar doesn’t stop there.

Each proposal also includes calculations for four key financial metrics:

- Net Present Value (NPV)

- Payback Period

- Total ROI

- Internal Rate of Return (IRR).

Let’s take a look at how each of these works.

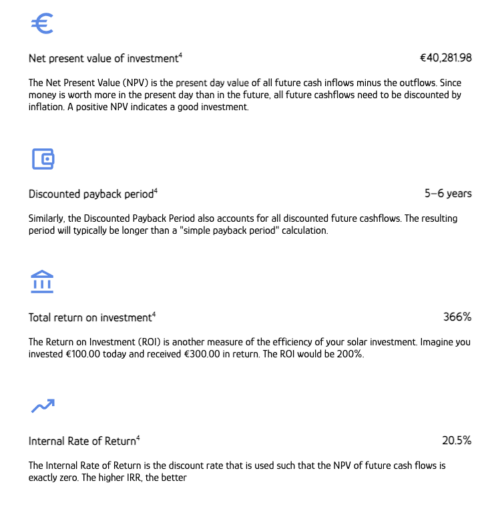

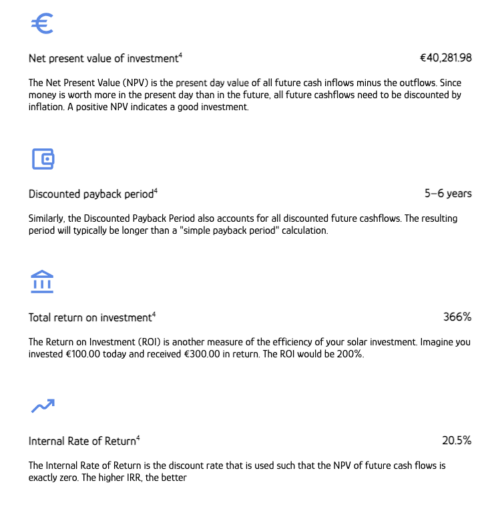

1. Net Present Value of Investment (NPV)

The Net Present Value (NPV) is the present-day value of all future cash inflows minus the outflows.

Since money today is worth more than money in the future, future savings on electricity bills (inflows) and the costs of installing the solar system (outflows) are adjusted to reflect their value today.

A positive NPV indicates a good investment.

Here’s how Marblanc Solar arrived at an NPV of €40,281.98 for this client:

- They calculated the total savings over the expected 25-year lifetime of the system

- They factored in inflation to discount future cash inflows (or realised savings)

- They then subtracted the initial investment cost of the system to arrive at the net value of the client’s investment

2. Discounted Payback Period

The Discounted Payback Period also takes into account all discounted future cashflows.

This period will be longer than a “simple payback period” calculation, because it takes into account the reduced value of future savings on electricity bills and the costs of the solar system installation.

This makes it a better investment metric.

Here’s how Marblanc Solar arrived at a discounted payback period of 5-6 years for this client:

- They calculated the client’s predicted annual savings (€1,946)

- They took into account inflation and performance degradation over time.

- They then mapped out the expected cash inflows (i.e. savings on electricity bills)

3. Total Return on Investment

The Return on Investment (ROI) is another measure of the efficiency of your solar investment.

Imagine you invested €100 today and received €300 in return.

The ROI would be 200%.

Here’s how Marblanc Solar arrived at a total ROI of 366% for this client over 25 years:

- They calculated the total savings over the expected 25-year lifespan of the system

- They divided the total savings by the system cost

- Then they multiplied by 100 to get the percentage

The total ROI of 366% means that. over the course of 25 years, the client will receive more than three times the value of their investment in savings.

4. Internal Rate of Return

The Internal Rate of Return (IRR) is the discount rate that is used to make the NPV of future cashflows equal to zero.

In the case of a solar installation, it represents the rate at which the future savings from reduced electricity bills would exactly offset the initial cost of installing the solar system.

A higher IRR indicates a better investment.

Here’s how Marblanc Solar arrived at an IRR of 20.5% for this client:

- They calculated the discount rate that would make the NPV of the client’s future savings equal to zero

- They considered the projected savings for each year

- They adjusted the rate to reflect the long-term savings and performance model

The Key That Most Homeowners Overlook When Buying Solar

Even with good predictions, not every homeowner with solar will achieve the kinds of savings seen in this case study.

Unfortunately, not every system performs the same.

Adam Millington, co-owner of Marblanc Solar, told the Olive Press he is often called out to inspect installations that were not carried out by his company.

In many of these cases he sees issues like:

- The client’s bills never fall to the expected amount, because of the system, so the client’s bills never fall to the expected amount

- The wrong cable sizes were used, leading to overloading of the system and reduced production

- The system was never legalised, so the homeowner couldn’t access a virtual battery deal and earn credit for surplus energy

- The system malfunctioned completely, and the installer refused to return calls

The solar industry lacks regulation in Spain.

And there are companies who take advantage, leaving homeowners with subpar systems and disappointing results.

Adam explains, “This is why Marblanc Solar introduced the most robust post-installation services on the market in Spain.

“We make sure our clients’ investments continue to deliver the savings they were promised.”

Marblanc Solar’s post-installation services include:

- Full legalisation of every system

- Free virtual battery deal comparison and switchover

- Two-week monitoring of production and consumption, with an electrician sent to optimise circuits and suggest plug timers

- Creation of a direct WhatsApp group with Marblanc Solar’s co-owners and senior electrician, John Bradley, available 24/7

- Free annual servicing for the first three years

- 25-year workmanship warranties, added to the 25-year equipment warranties – ensuring Marblanc Solar is liable for any underperformance or malfunctioning

- Emergency callouts, even on weekends

Roman Mitchell added that with solar, the “cheapest” system can often mean the worst savings.

“We introduced our post-installation services to help clients make the most of their 25-year investment, just as promised in our proposals,” he said.

How to Calculate The Return on Your Own Solar Installation

This example is proof that solar can be a worthwhile investment.

But it also highlights the importance of accurate system design, installation and post-installation services.

Let’s recap on why solar can be a great investment:

- Solar can be considered savings, as it’s money you would otherwise have spent on electricity.

- The ROI can be much higher than long-term investment accounts and even stock market indexes — in this case, a 17.7% return.

- When you go solar, inflation only increases your savings, as energy costs rise while your solar output remains stable.

- There is much less risk involved in investing in solar compared to other investments. Unlike the stock market, electricity bills are a constant, predictable cost.

- Over a 25-year lifespan, solar can help you retain thousands of euros you would have otherwise paid to an energy company – in this case, over €40,000.

If you’re ready to see how much you could save, contact Marblanc Solar today for a Free Solar Survey – or call +34 951 82 30 83

Their team is ready to help you understand your potential return on investment and show you how solar can work for your home.

Click here to read more Environment News from The Olive Press.